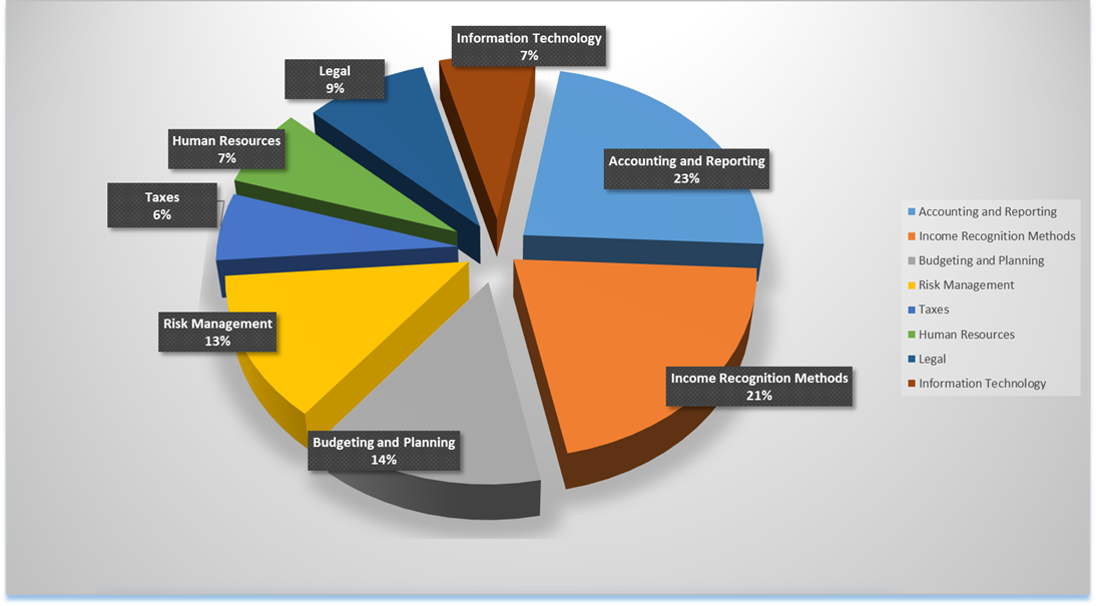

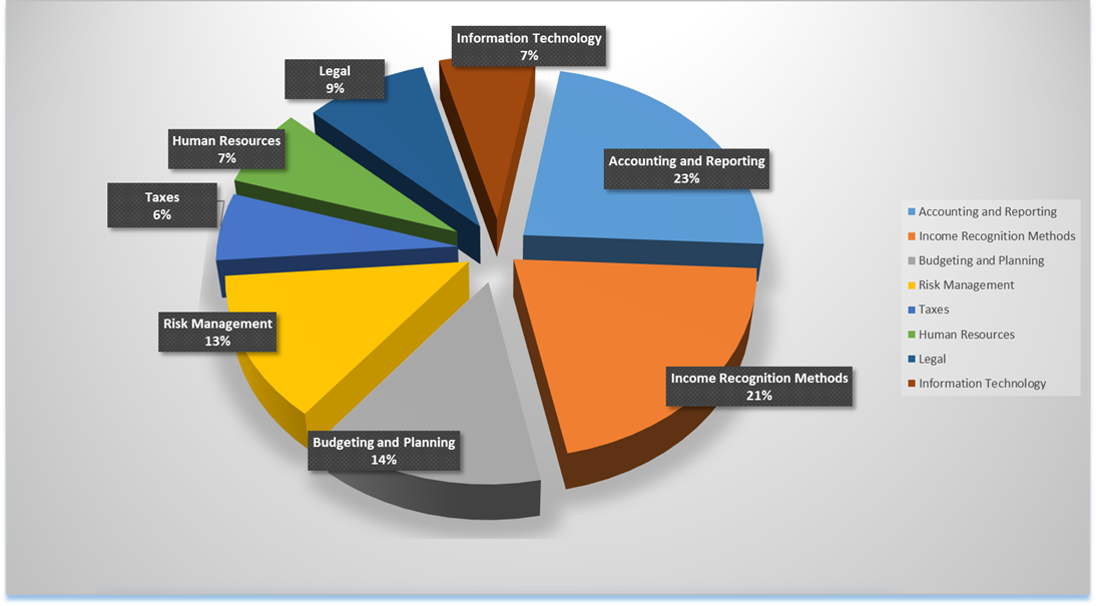

CCIFP Knowledge Domains (updated 2020)

The following is a detailed outline of the eight knowledge domains of the exam, with an indication of the approximate percentage of the construction finance exam devoted to each area:

ACCOUNTING AND REPORTING (23%)

- Accounting standards and guidelines

- Basic methods of accounting

- Receivables

- Leases

- Costs in excess and billings in excess

- Construction equipment

- Subcontractor payables

- Independent construction audit

- Financial statements

- Project management

- Gross profit analysis

REVENUE RECOGNITION METHODS (21%)

- Financial reporting

- Percentage-of-completion accounting method

- Contract revenues, change orders and claims

- Contract costs

- Accounting for the effects of change in estimates

BUDGETING AND PLANNING (14%)

- Strategic planning

- Strategic cost management

- Capital budgeting

- Cash management

- Benchmarking

- Succession Planning

RISK MANAGEMENT (13%)

- Risk management responsibilities

- Construction-related insurance

- Surety

TAXES (6%)

- Accounting methods unique to the construction industry

- Tax filing

HUMAN RESOURCES (7%)

- Compensation

- Employee benefit plans

- Accounting/finance department administration

- Labor and ERISA laws

LEGAL (9%)

- Preparation and review of contracts

- Subcontracts and purchase orders

- Applicable laws

- Warranties

- Alternatives to litigation

INFORMATION TECHNOLOGY (7%)

- Construction management platforms

- Evaluation, implementation, selection and integration methods

- Cybersecurity

|